The only company in Kazakhstan, which provides its reinsurance coverage to international companies

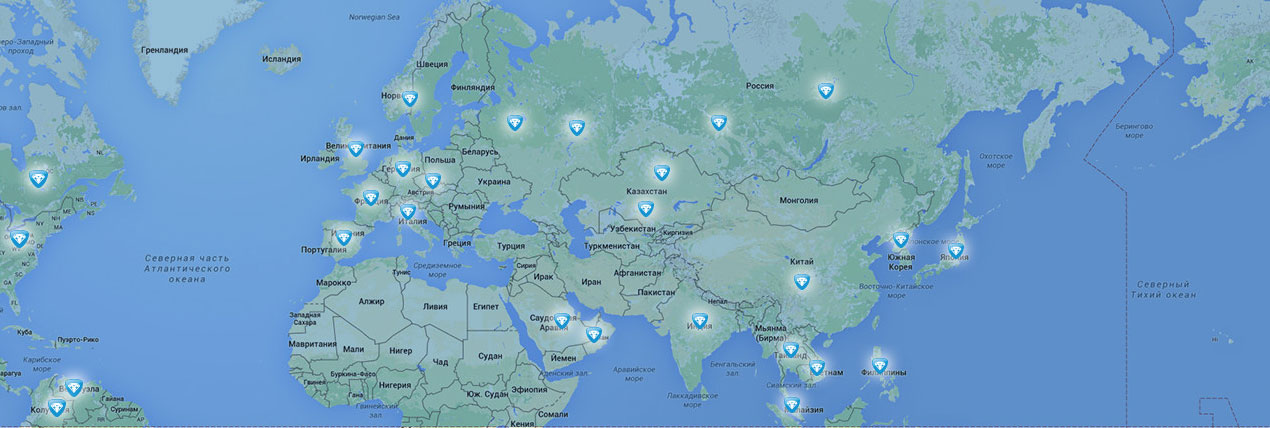

The Company is among the top insurance businesses in the CIS countries and is included on the list of the insurance companies approved in the international reinsurance market. It’s inclusion by such leading international insurance brokers, as Marsh, Willis Towers Watson, AON, Guy Carpenter, Howden Re, Miller, attests to the quality and reliability of the company’s reinsurance coverage in the international reinsurance market.

International membership:

Eurasia IC JSC is provided with reinsurance coverage by SCOR SE and Hannover Rück SE, leading international European reinsurance companies, rated A+ and AA- by Standard & Poor’s, respectively.

These ratings are generated by International rating Agencies and represent company reliability measure

On June 25, 2025, the largest S&P Global Ratings rating agency has confirmed the issuer’s long-term credit rating and financial strength rating of Eurasia Insurance Company JSC as “BBB”, maintaining a “stable” outlook. The rating of Eurasia IC on the national scale has remained at the level of "kzAAA". The rating of Eurasia IC JSC is historically the highest credit rating among all private financial institutions in the Republic of Kazakhstan.

On September 4, 2025, the A.M. Best international rating agency revised the outlook of Eurasia Insurance Company from “Stable” to “Positive,” while affirming the financial strength rating at B++ and the long-term issuer credit rating at bbb+.

Mass media

Aerospace

There was an accident and you have encountered a problem? Don’t you worry if you have an insurance policy with Eurasia IC JSC. We sympathize with you and are ready to give you our assistance and support.